India’s Aavishkaar attracts Japan LPs with credit strategy buildout- Interview of Abhishek Mittal, Partner, Aavishkaar Capital with Asian Venture Capital Journal (AVCJ)

- Japan’s JICA backs debut credit fund after three years in market

- Development finance institutions to be more than 75% of fund

- GP expects its equity, credit AUM to be equal in value by 2030

Indian early-stage impact investor Aavishkaar Capital is tracking increased interest from Japanese LPs following the addition of a private credit strategy.

Last month, the firm received a USD 40m commitment from Japan International Cooperative Agency (JICA), a development finance institution (DFI), for its Global Supply Chain Support Fund. The vehicle provides private credit to small and medium-sized enterprises (SMEs) across India, sub-Saharan Africa, and Southeast Asia.

“This JICA investment opens up a whole new fundraising market for us. We’ve had small Japanese commitments in earlier equity funds, but this allows us to engage larger Japanese institutions and talk about USD 20m-USD 40m LP cheques,” said Abhishek Mittal, a partner at Aavishkaar.

The fund was launched in January 2022 with a #exible equity-debt mandate, originally targeting USD 250m under the name ESG First Fund. That year, German development bank KfW provided an anchor commitment of USD 58m. A first close of USD 120m came in December 2022, according to AVCJ Research. The hard cap has since been reset to USD 220m. With the rebrand, the focus has shifted to credit over equity. Mittal said he is aiming for a final close by December 2026. Interest from Japanese investors is hoped to trickle into the equity strategy, creating a foundation for future commitments.

“We expect to add at least one more Japanese investor — non-DFI — into both our equity and credit strategies going forward,” Mittal added.

More broadly, Aavishkaar claims to be in discussions regarding USD 150m-USD 160m of DFI capital commitments, with over USD 100m of this said to be in advanced stages.

More than 75% of the credit fund is expected to be raised from DFIs. Family offices and foundations writing smaller cheques will take up the rest. Larger institutional LPs will not feature.

Aavishkaar has been building out its credit strategy since launch. It now has an eight-member investment team, including three partners. Dedicated back-office staff bring the credit team count to 12. India and Africa have established on-the-ground teams. The Southeast Asia presence is slowly building.

“Historically, Aavishkaar had been seen as an equity investor, so we invested time in creating a dedicated investment process and back office for debt,” said Mittal. “Equity is generally not available because these businesses don’t create exit opportunities. An SME is typically not an attractive investment from an equity fund perspective, because they’re generally not going to generate multi-bagger returns.”

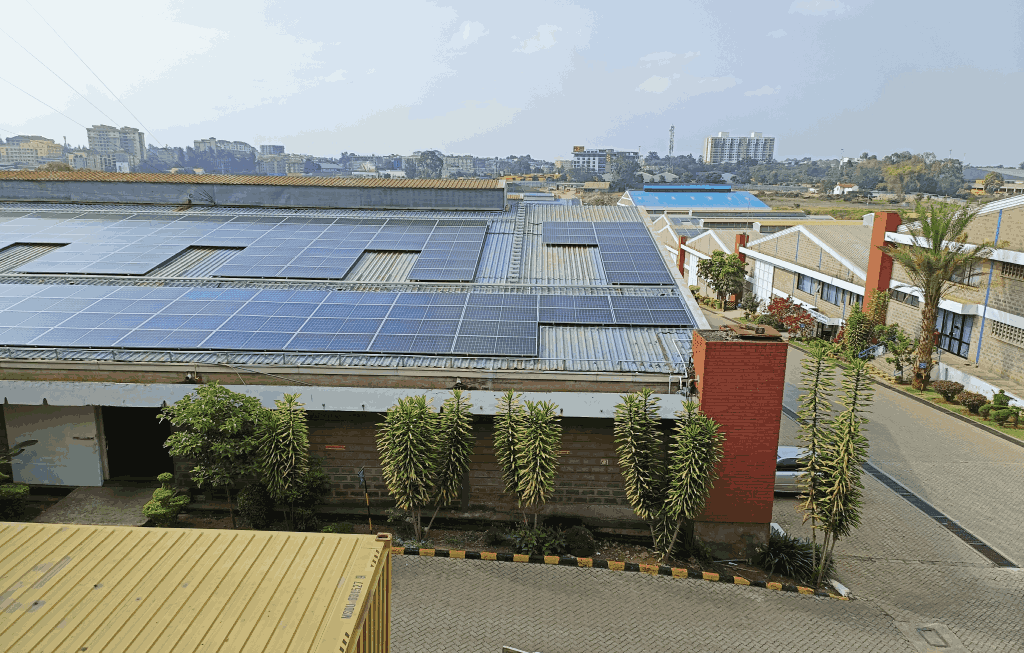

Global Supply Chain Support Fund has made eight commitments to date. They include Kenya-based macadamia product exporter Privamnuts, auto-grade steel processor Poshs Metal in India, spices supplier, Horizon Group, which has facilities in Nigeria, Tanzania, and Madagascar, as well as India’s INI Farms, an exporter of fruit and vegetable crops.

“I think the big thing is that these are not start-ups. These are SMEs with longstanding operations. In our current portfolio, the youngest business is six years old, and the oldest business is more than 30 years old,” he added.

Loans are typically in the USD 3m-USD 7m range with three to five-year tenors, designed to fund growth needs such as expansion plans, new product and business development, and capital expenditure.

“For them, bringing in an equity investor doesn’t add much value. Their operations are streamlined. They’ve been doing the same thing for 10–15 years,” Mittal said. “Investors – apart from capital – don’t bring much in terms of operational expertise or business expansion. We help them institutionalise, set up governance structures, and prepare them in case they ever want equity. But many may never raise equity or list.”

Periodic returns under a shorter-than-usual private credit structure translate into an ability to scale – so much so that Mittal expects the firm’s assets under management (AUM) for equity and credit to grow and reach equal value over the next five years. Aavishkaar has raised eight funds to date and claims approximately USD 550m in AUM.

“With credit, you can raise larger funds – that’s essentially how we see it. By that time [2030], if not at par, our equity AUM should be close to USD 1bn and our credit AUM should be USD 700m-USD 800m,” Mittal added. “We don’t see credit as a move away from equity. We see them as complementary strategies. Equity continues to back high-growth, multi-bagger opportunities. Credit comes in as a complementary offering for businesses that aren’t suited for equity but still need capital.”

Read more in AVCJ (Subscription Based) –ION Analytics